|

"Psion accompanies its clients from productivity improvement through business growth to value extraction" | sitemap contact |

|

Every successful business follows a lifecycle - it starts, grows, matures and ultimately, it transfers to new owners. We understand the needs of a business at every stage of its lifecycle. By keeping abreast of your evolving needs, we can develop financial solutions to help you grow and realise wealth. Select any of the business considerations below to learn how we can help your business throughout its lifecycle. |

Psion makes use of a constantly up-dated tool box of consulting products |

| Investment Thesis | Productivity Improvement | Business Growth | Value Extraction |

| Due diligence | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Diligence requires a thorough understanding of the business and the role the business fulfills in the value chain. Psion Partners takes a custom approach to each due diligence process. Some of the areas that can be covered are:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Financial modelling | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Benchmarking | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Driving change in the organization through analysis of cost gaps to achieve world class performance To close this gap several steps can be undertaken such as:

Usually a post-Benchmarking internal project team is assigned the task of implementing the efficiency improvement measures from the benchmarking team so that the key learnings percolate through to the whole organization. |

Moving to new levels of productivity through implementation of key learnings from the Benchmarking project | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Time Based Management | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

TBM is used to increase the effectiveness and reduce costs in for example large projects. Project duration can vary but typically from conception through to implementation and controlling could be up to 1.5 years. Some of the key outputs are:

Perceptible results achieved through use of these newly crafted tools are for example better Return on Sales (ROS) and a significant acceleration of the delivery period of projects, sometimes halving traditional performance |

Through improved Project Management processes, project sizes increase and costs and delivery times are reduced | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Market positioning and tactical revenue | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Collaborative development with client of :

to optimize strategy, positioning and resource allocation in relation to present and prospective market conditions Help management work through the tactical and strategic activities to move from initial traction to sustainable market momentum. Psion Partners can help find the right balance between short-term tactical needs and the longer-term strategic requirements by delivering sales opportunities and sales management |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Value mapping and value chain evaluation | |||||||||||||||||||||||||||||||||||||||||||||||||||||

As part of the exercise to find :

value chain and customer expectation mapping can be very helpful in understanding where value can be created to increase top as well as bottom line growth. Below are examples from a past project | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

The diagram on the right shows the value line for the 3 companiesThe diagram below shows the telecoms provider value chain analysis |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

Typical customer prepaid card: currency unit 5,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio evaluation and future direction | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

A company needs to re-evaluate its position on a regular basis to determine where portfolio investments are most effective and in line with the broader interests of the wider group. Decisions need to be taken to prioritise drives within the company to establish:

Through this exercise missing product offerings and targeted resource planning result. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Development of guiding principles Develop guiding principles / strategy to decide on a company's future core direction |

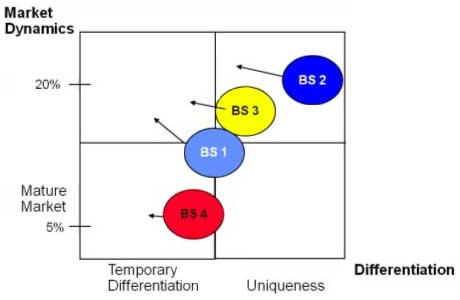

Uniqueness portfolio

Determination of your present product portfolio uniqueness to allocate resources to Business Segments (BS) appropriately | ||||||||||||||||||||||||||||||||||||||||||||||||||||

Project Examples

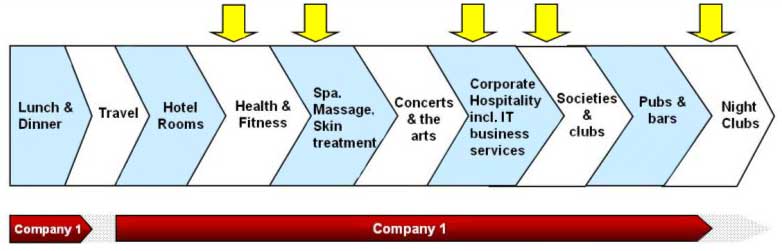

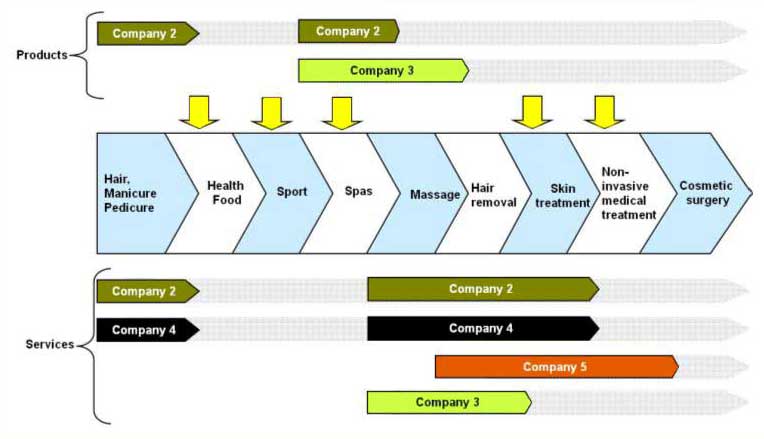

Below are examples of an investment house making sense of its existing portfolio of wellness companies and looking for the next logical investment Executive Leisure Value Chain

Determination of the complete value chain to identify gaps that need filling through organic or M&A growth (yellow arrows indicate the segments of the value chain that this customer needed to improve or expand its offering). Through adjusting their product offering and allocating resources intelligently, this customer was able to increase its product offering along the value chain at little additional cost. Beauty & Aesthetics Industry Value Chain

Determination of the complete value chain to identify gaps that need filling through organic or M&A growth (yellow arrows indicate the segments of the value chain that this customer needed to improve or expand its offering). Through intelligently integrating these product offering and allowing cross-selling between companies, the high end customer base was offered a multitude of services hence increasing customer loyalty at little additional cost to all organisations involved held by the same investment house. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Strategy review | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

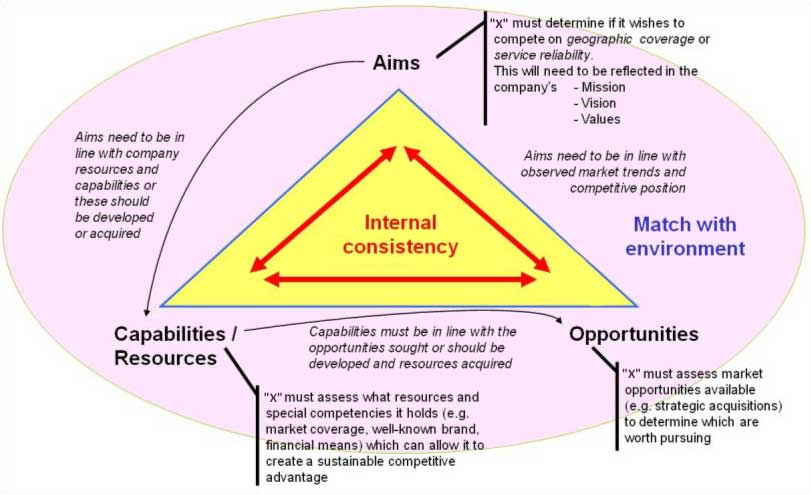

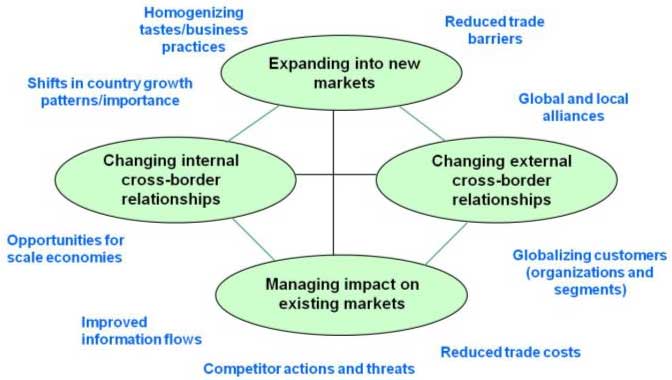

Companies should engage in strategy review processes on a regular basis. Strategy review processes usually evaluate the strategic alternatives that may be available to maximize value for the Company and its shareholders The strategic review could encompass a careful assessment of:

An example of some of the areas that were covered in previous projects can be seen below. Click on the images below to load the full size diagrams in a pop up window. Project Examples | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Testing strategy content

| Geographical expansion

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

| SWOT analysis | |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

This tool is used to complement research and expert interviews and quickly assesses the strengths and weaknesses of a business. It facilitates the identification of measures required to improve a business' market position. This could lead to a whole series of different but targeted projects to gain a better understanding of how to mitigate weaknesses and play more to strengths Examples of the SWOT analysis tool in use in previous projects can be seen below. Click on the images below to load the full size diagrams in a pop up window. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

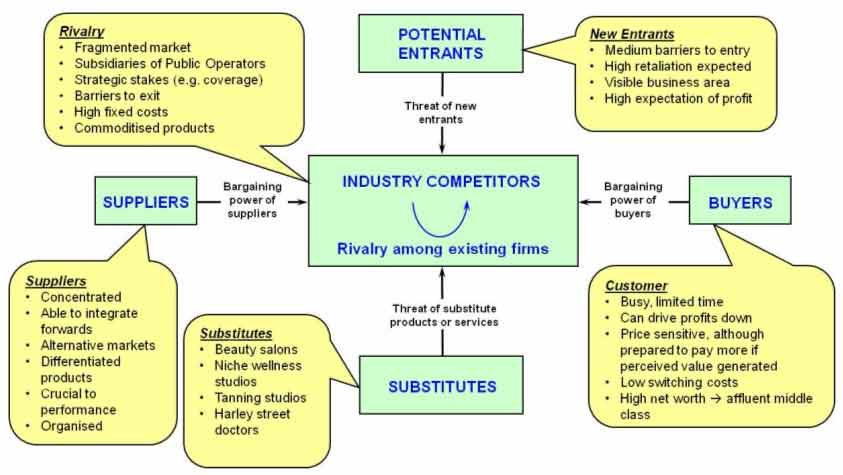

Porter's "Five Forces" Analysis of Industry Structure: What puts pressure on profits for the Executive Leisure Value Chain - Company 1

|

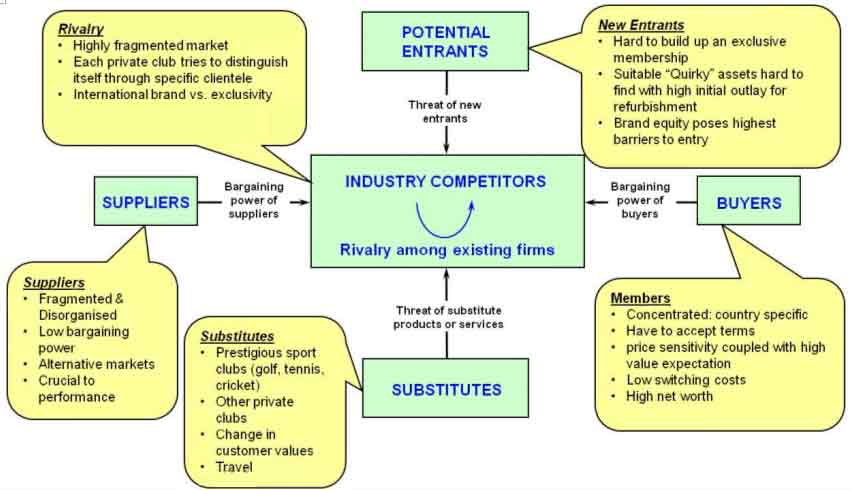

Porter's "Five Forces" Analysis of Industry Structure: What puts pressure on profits for the Wellness industry - Company 5

| ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Merger & Acquisition (M&A) process | |||||||||||||||||||||||||||||||||||||||||||||||||||||

In order for a company to grow beyond its organic potential, a company at certain points in its growth needs to consider buying complementary bolt-on businesses. This process can be fraught with difficulty and therefore engaging the assistance of an experienced external impartial party can be very beneficial, saving time spent climbing the learning curve. Psion Partners has tools in place to give the systematic support required (see below). Some areas that need consideration are:

The BUY process needs to align the market environment, shareholder objectives and company conditions in order to be successful | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

Psion Partners Added Value | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exit planning | |||||||||||||||||||||||||||||||||||||||||||||||||||||

With few exceptions, exit planning is the most difficult period for any CEO or investor. Research shows that many owner managers fail to achieve the transition successfully - and do not receive their expected value. Psion Partners understands the boundaries and expectations and is able to advise and implement an exit. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

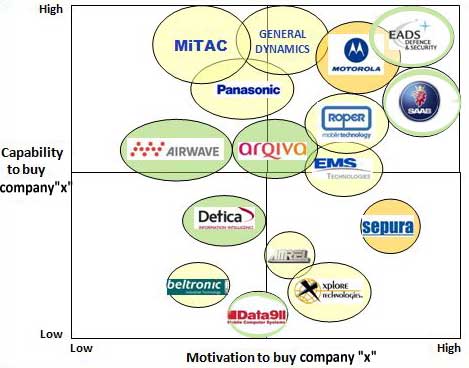

Potential trade sale exit routes for Homeland security technology company |

Size of circle illustrates size of company - FY2008 unless otherwise stated Hardware provider like company "x" and in the Public Safety Sector (PSS) Hardware provider like company "x" but mainly supplies other markets Associated hardware provider in MDT (Mobile Data Technology) and PSS market System integrators / Infrastructure providers | ||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||